Searching for new software is tough. With Sage 1000 and Sage Line 500 riding into the sunset at the end of 2024, many companies have been forced to search for replacement solutions.

But new software can bring new opportunities. It can give businesses a chance to bolster their operations by switching to a more function-rich, coordinated Enterprise Resource Planning (ERP) system.

Researching new solutions takes time, so if you’re weighing up your options, you’re in the right place. If you’re looking to switch from a dying Sage product; feel you’ve outgrown your current accounting packages; you’re sick of juggling separate systems; or you’re eyeing up a more powerful business management solution, BrightBridge is here to help.

Today, we compare two major players in the ERP market: Sage Intacct and Oracle NetSuite. Contenders, ready!

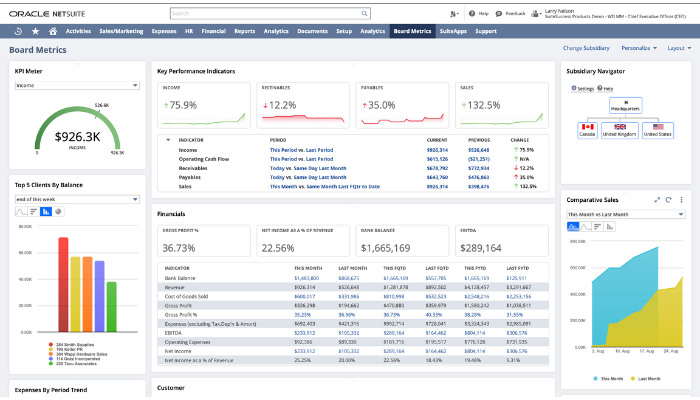

Oracle NetSuite is an industry-leading, cloud-based Enterprise Resource Planning software suite with broad cross-market appeal. It includes fully integrated financials, a CRM, inventory management, a broad suite of analytics capabilities, and can even help you manage e-commerce stores and subscription plans.

All in all, it provides a real-time, at a glance, bird’s-eye view of your entire business.

Sage Intacct is a web-based financial management platform, aimed at English and French-speaking mid-size organisations. It’s bundled with generous ERP functionality out of the box, with project accounting, contract management, inventory management, global consolidations, and more available through optional add-ons.

Intacct is also available in a “Starter Edition” which is designed to be more accessible and cost-effective for smaller businesses.

Let the Oracle NetSuite vs. Sage Intacct comparison contest begin…

Though both solutions are rightly marketed as ERPs, Intacct is focused much more squarely on financial and accounting capabilities. NetSuite offers a far broader feature set, as we’ll explore below.

Basic Accounting – Both solutions take basic accounting functionality for mid-market companies in their stride, as you might expect! Accounts payable, receivable, general ledger, timesheet management, cash management, fixed assets, and so on are all handled with ease by both platforms.

Subscription & Contract Management – If you rely on subscriptions and ongoing contracts, then both solutions have all of the tools you need to reduce the costs and complexity associated with recurring billing.

Production & Supply Chain Management – NetSuite provides a lot more functionality here, with the capability to handle product data, planning, quality assurance, barcoding, and Work-in-Progress (WIP). Both solutions include basic procurement and order/inventory management, though NetSuite is better set-up for supply chain planning; warehousing and fulfilment; and demand planning.

Business Intelligence & Analytics – Both NetSuite and Intacct allow your average user to create custom data fields and reports. However, if you need up-to-the-minute reporting (and who doesn’t nowadays?) know that Intacct relies on batch processing, so you can’t just dip in and get a full, real-time picture of operations at the drop of a hat. NetSuite always presents up-to-the second data, platform-wide.

CRM – Intacct does not include a CRM, but does have a powerful, native integration with Salesforce, so if you already use Salesforce, that may be a tick in Intacct’s box for you.

Project Accounting – Project accounts is another of Intacct’s optional extras, but it comes natively packaged and immediately present within NetSuite, out of the box. Intacct’s add-on has good functionality, with solid reporting and dashboards – but it comes at an extra cost.

Availability & Localisation – Alas, Intacct is only available in English and French and its multi-currency and multi-company functionality is limited. In fact, multi-currency functions are charged as an extra module within Intacct. NetSuite, however, supports 27 languages and more than 190 currencies, plus tax and reporting standards for more than 100 countries.

Sage is widely known for its on-premise software solutions but refreshingly, Intacct is completely cloud-based and accessed via a web browser. Both Sage Intacct and Oracle NetSuite are completely, natively cloud-based, so there’s no need to install or maintain servers or software yourself.

This means that regardless of which of these two solutions you pick, it will be available through any browser, at any time, wherever you are in the world. And because both solutions are fully updated by Sage and Oracle respectively, you will always be using the latest version.

Both solutions feature business intelligence and analytics capabilities with a range of pre-built dashboards and reports. However, Intacct’s offering lags behind NetSuite’s somewhat. Let’s use core financials as a quick example: Intacct provides 69 pre-built reports, whereas NetSuite provides 200.

Sadly, there are limits to the flexibility of Intacct’s reports, too. Some additional functionality and flexibility can be provided through add-ons, but these all add potential complexity and cost. Additionally, Intacct’s reliance on batch processing means that achieving up-to-the-second reporting accuracy is difficult.

NetSuite however provides total “self-service” data-probing and reporting capabilities. Through pre-built dashboards, users can drill down to granular data points in real time to support faster, more confident decision making.

Compared to other Sage offerings like 200 and X3, Intacct allows for a lot more customisation and automation. Both NetSuite and Intacct let you easily set up custom reports and dashboards; insert custom fields; and create custom workflows. You can also hook up a number of third-party modules to augment that.

However, we still think NetSuite wins this round. NetSuite has so much functionality and customisation options out of the box that the need for additional modules is far less likely for a wider range of industries and sectors.

As both platforms are completely cloud-based and accessed through a web browser, software updates are crafted and released by NetSuite and Sage, and become immediately available to their users upon release.

In either case, when you need support, your first port of call should be your software partner or support contractor. The majority of our customers take out an ongoing support contract with us to ensure full post-implementation support after the project hyper care period ends (that’s the ultimate hand-holding experience after go-live). So, no matter how small the question or how large the challenge, our support team is on the other end of a phone or an email during office hours.

Though migration speed is rarely the be-all and end-all when choosing Enterprise Resource Planning software, it certainly plays a factor in the decision. In this particular battle, one of the two solutions is clearly quicker to set up, but we’d argue that good things come to those who wait…

The Sage Intacct website boasts that you can “go live in as little as 60 days with a system tailored to your needs”, though it’s important to note that this is for financials only, not an ERP-wide implementation! A strictly “financials-only” setup within NetSuite would likely take around 60 days too.

But if we’re talking about a full ERP implementation, depending on the complexity of the company concerned, NetSuite can take from 100 days to 6 months to set up; however, this highlights NetSuite’s more feature-rich nature. More time is needed to get all of the useful bells and whistles working under the bonnet, so you’ll likely see a much speedier “time to value” once it’s all ready.

BrightBridge is able to accommodate phased setup and implementation for NetSuite, so you may be able to start using the platform (and seeing that time to value) even sooner.

As with any piece of software, costs and charging structures depend on things like number of users and additional required functionality. When it comes to setting up an ERP solution, you should expect to pay an initial implementation fee, and then a yearly or monthly licence fee.

Akin to other Sage tools, Intacct’s pricing can appear a little complex. Intacct customers pay:

This complexity can seem daunting, but there is a silver lining. When you pay separately for each user and element of functionality, you potentially receive more granular control over what you spend.

NetSuite however, is a lot more straightforward:

Though prices will always vary wildly from use case to use case, NetSuite’s feature-rich, full ERP solution weighs in a little pricier than most instances of finance-focused Intacct. This reflects the sheer amount of extra functionality NetSuite users will get out of the box.

If you’re concerned about costs, speak to us about Oracle Finance to spread the cost of our service fees over three years.

NetSuite’s core benefits lie in the sheer breadth of its “out of the box” functionality. Though your partner/provider will help you maximise the specific functionality that you need, NetSuite provides vast functional territory to explore, all without having to juggle add-ons or extra payments.

And if you’re specifically looking to move away from Sage, or you need a global platform that handles multiple business entities, currencies, and languages with ease, NetSuite wins hands down. NetSuite gets extra marks if you are likely to need up-to-the-second reporting and extensive warehousing and supply chain controls.

Despite NetSuite’s many plus points, there are a few situations where Intacct may be a more sensible choice. If you’re already using a Sage product and Salesforce, and you simply need financial software with a dash of ERP functionality, then switching to Intacct may be the more painless of the two options.

Additionally, if you don’t work in a way where up-to-the-minute figures are needed at the drop of a hat (which is increasingly unusual nowadays), then Intacct is fine.

Though Intacct puts up stiff competition, we would unequivocally proclaim NetSuite the victor here.

Both are strong ERP offerings, but we’d argue that it would be far easier to “outgrow” Intacct, leading you to have to source and implement a new piece of software from scratch later down the line; or juggle an increasing amount of add-ons as your needs change over time. NetSuite, however, is much more future-proof. With that in mind, if you’re looking to grow – especially internationally – then NetSuite is a must.

NetSuite’s out-of-the-box language, currency, and localisation options are far more generous for a company looking to spread its wings globally. Compare that to Intacct, which is only available in two languages and you have to pay for the privilege of using multiple currencies!

Personally, we also find NetSuite’s supply chain management functionality far more comprehensive, its expansive analytics are in true real-time, and allows for much more granular data juggling from day one.

All in all, NetSuite is capable, scalable, and firmly today’s winner.

Once you’ve made the decision to move on from spreadsheet accounting or to upgrade your legacy ERP system, how do you choose the right ERP software?

When you manage your whole business through an ERP system, you’re able to get a bird’s-eye view of your business, and better understand company-wide impacts of decisions, plans and unforeseen changes. This coordinated view is a real boon for companies looking to grow and to increase efficiency.

It’s essential to quantify the value and expected returns from implementing a new ERP system like NetSuite. After all, any new IT system is a substantial business expense, requiring a compelling business case to gain buy-in from stakeholders.

As businesses strive for efficiency, they are increasingly turning away from on-premises technology and moving to the cloud. As testament to this shifting trend, statistics indicate that cloud ERP is forecast to grow at more than 17% between 2022 and 2028.

ERP systems help companies automate and streamline operations, but how can they tackle the problems posed by inventory management?

The NetSuite 2023.2 Release Notes are out and our expert consultant has detailed the best enhancements and new features for you to implement.